Not a couponer? Don’t have enough to stick a big chunk in savings every payday? Me either. But I still want to save some money. Maybe to treat myself, for a family vacation, or saving up for a big item. Regardless of the reason, there are a few tricks you can try that help put some money aside without missing it from your regular budget.

Round Up to the Next Whole Dollar

I do this all the time when I use my debit card (which is most of the time, I don’t often have cash and if I do, it’s not much). So if I buy something for $4.56, I round up to $5.00 when I deduct it from my check book, so that extra change just sits there in a black hole collecting from every purchase. After a while it adds up…I generally end up moving at least a couple hundred bucks over to savings at least two or three times a year from doing this. Christmas shopping fund anyone?

Change Jar

This is pretty self-explanatory and I think that just about everyone has had a change jar at one time or another. I will admit, it starts off slow, but if you actually use it daily, the money in that bad boy can add up. If you pop in some paper money with all that change, you can have a pretty good kitty built up in 6 months or a year. Last time we emptied it after about 6 months of saving up and we had over $100 to take the kids to the fair with. You may think that’s not much, but I’ll tell you, at that time, there would’ve been no trip to the fair without it for us. And really, what have you got to lose? You may end up with a nice dinner out, some new shoes or an emergency tank of gas out of it.

$5 Bill Plan

This one is a little harder because, well, five bucks is five bucks and to me, that’s not as easy to part with as some change or a one dollar bill. If you are able to do it though, this one can add up fast. It’s basically the same principle as the change jar, except using the $5 bills that you get back as change. If you are one that uses cash more than debit, this would probably work better than the rounding up option.

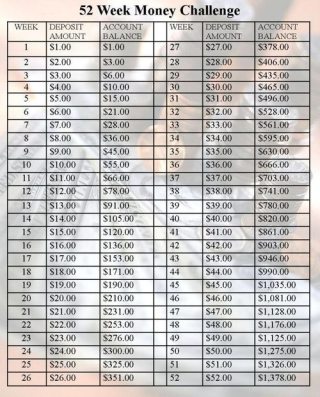

52 Week Challenge

This has been passed along around the internet quite a bit for the past couple of years (well, I only noticed it in the past couple of years) and it’s actually a pretty cool little challenge. Basically you put away an amount of money that corresponds with the week of the year. (Ex: Week1 = $1, Week 5 = $5, Week 27 = $27, etc.) If you do this every single week for the entire year, you should end up with over $1300 saved. Now that’s not pocket change, that’s a pretty good chunk of money. We tried this last year and unfortunately didn’t finish the challenge – we had an emergency come up in the fall and let me tell you, we were glad we had that $400+ stashed away. Needless to say I love this challenge and have started it again this year and hope to be able to follow it through to completion this time. So far, so good.

Cut Out Unnecessary Spending

Everyone says that right? Well, that’s because it works. Do you eat out 3 times a week? Make it two and put that $30-50 in the bank. In one month you’ve got a couple hundred extra dollars. Buy a $5 coffee every day? (That was me…sometimes two.) Cut back to three times a week – there’s $20 a week right there, almost $100 a month. Are you a smoker? Those babies are not cheap! While quitting may be ideal, I realize that’s not for everyone so maybe just reduce the number of cigarettes you smoke each day, which will result in fewer packs and eventually you’ll notice you’re not spending quite as much. Every little bit counts!

What’s your best tip for saving money without putting a burden on your budget? If you could save some extra cash up, what would you do with it? Let me know in the comments below and thanks for reading!

Pam R says

Pam R says

March 21, 2014 at 8:24 amIv seen some of these tips— like the 52 weeks chart.

Alison says

Alison says

March 21, 2014 at 12:57 pmHave you tried any of them Pam? How did they work out?

tara pittman says

tara pittman says

March 21, 2014 at 9:33 amI love to save money. I look for deals when shopping and use coupons

Alison says

Alison says

March 21, 2014 at 12:58 pmI try to use coupons as much as possible, but I’d totally fail at extreme couponing. If I save $5 with coupons its a good day 🙂

Christy Garrett Parenting Tips says

Christy Garrett Parenting Tips says

March 21, 2014 at 1:42 pmI started using coupons to find amazing deals on products that we use. 😉

Lady Tyrneathem says

Lady Tyrneathem says

March 23, 2014 at 2:18 pmGreat ideas! The rounding up on purchases would work great for me, because I deal almost exclusively with my debit card.

We are planning to do the 52-week plan next year. I know it works, because my parents followed a similar plan to save up for Christmas gifts. We have a lot that happens later in the year that would make it more difficult to save the larger amounts, so we start the year with the larger amounts… sort of reversing the 52-weeks. 🙂

Michelle F. says

Michelle F. says

March 23, 2014 at 10:16 pmThose are some really great tips. I have been wanting to try the 52 week challenge.

Erinn S says

Erinn S says

March 24, 2014 at 9:49 amWe do the change jar and my husband will take $5 change and throw it in there too. We had a Vegas trip off of a year of change saving!

Alison says

Alison says

March 24, 2014 at 12:50 pmThat’s awesome! That’s what I’m shooting for this year — a long weekend in Vegas since it’s going to be our 5th wedding anniversary and that’s where we went for our Honeymoon. So far so good & hopefully we don’t have to “borrow” from the fund for anything!

Terri says

Terri says

March 24, 2014 at 2:44 pmi dream of a vegas wedding

Stephanie says

Stephanie says

March 27, 2014 at 8:28 amMy parents have no money saved for retirement, and refuse to do any of the things you mentioned. It drives me batty, because I’m the only child, so guess who will be footing the bill for their nursing homes in 20 years. Alllllll me! The eating out thing seriously upsets me. They probably spend $200 a month eating out, plus another $40 a month buying DVDs. Even if they just bought one movie a month, that’s still a $240/year savings. And they have tens of thousands in credit card debt.

I’m the opposite of them.

I did away with tv service years ago; now I just wait an extra week to watch programs online for free, and pay my $8 to Netflix every month. I save $840 a year this way.

I buy reusable organic products, which initially may seem like they cost more, but in the long run, they are waaaaaaay cheaper.

I make my own laundry detergent. It costs me $20 a YEAR and absolutely cleans better than Tide ever did, and my front loader no longer smells funky. It absolutely baffles me that more people don’t do this. It takes me 10 minutes to mix up a batch of soap and it lasts months.

Alison says

Alison says

March 27, 2014 at 9:31 pmI got rid of cable too and use just Netflix and Amazon Instant Streaming — soooo much cheaper and I really don’t miss having cable enough to go back to the $100+ a month bill! And eating out is HUGE – at $40 a meal (which is our average for a “cheap” meal with a family of four) if we cut out 1 trip a week, we’re saving over $100 a month there too. Just think about how much we could save just be cutting back on unnecessary splurges even if we don’t completely give them up! Thank you for sharing some of you tips too…making my own laundry detergent is something I’ve been wanting to try by haven’t gotten around to yet.

Bismah says

Bismah says

April 20, 2014 at 5:02 amI like to think of saving money as a challenge. It can be fun at the same time. I would think that cutting out of unnecessary spending is probably the easiest way to save some money. Everyone tends to spend some money on things that is not really needed. For my family we just recently cut back on buying take away food. We will still have it on occasion, only not as often.

Mandy, Barbie Bieber and Beyond says

Mandy, Barbie Bieber and Beyond says

April 22, 2014 at 4:12 pmSuch great tips!! Thank you for linking up to “Stumble Through The Weekend”, I will be featuring your post this week too. Mandy

Alison says

Alison says

April 23, 2014 at 9:01 pmWow! Thanks a ton and thanks for stopping by!

lori crockett says

lori crockett says

May 5, 2014 at 7:56 pmwoah… I found this randomly on stumbleupon, and I actually know you! 🙂 loving your blog!

Alison says

Alison says

May 5, 2014 at 8:11 pmThanks hun!! Glad to know that people are actually reading and enjoying it! (and Stumbleupon works lol).

Jamie (Mama.Mommy.Mom.) says

Jamie (Mama.Mommy.Mom.) says

June 17, 2014 at 7:11 pmUgh! That last one is a hard one! I always say I’m going to cut out this or that, but it’s so hard!

Rachel Hirst says

Rachel Hirst says

December 2, 2014 at 4:43 amSome really great tips here! In the UK we don’t have half as many great coupon deals like you guys do over there. I always watch programmes on TV showing how much you can save if you shop savvy in the states, us Brits kind of have no great options for saving at the checkouts. Thanks Rachel Followed on Twitter and Thumbs up on Stumbled Upon!