The hustle and bustle of the holidays are upon us. Everyone is busy and preparing for all the festivities to come. As many of you may have figured out, I’m an insurance agent by trade – meaning that’s my “real” job that I go to 40+ hours a week. Since I deal with insurance day in and day out, this time of year always gets me thinking about my own insurance coverage. Weird right? I should be thinking about food, and baking, and family, and decorating instead of my insurance coverage. Well I do think about those things….rather I stress about those things, but this time of year also opens families up to a whole new set of exposures that you want to make sure your insured for.

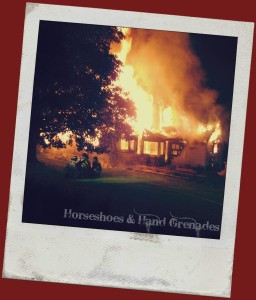

How many news reports do you see the day after Thanksgiving where someone’s home burned down due to a deep fried turkey tragedy? Do you live in an area with a lot of snow and if you do are you 100% sure that all your structures are going hold the snow load again this year? Anyone seen the photos of trees in homes and on top of cars after the crazy wind storms that have been occurring the past several weeks? What is a thief’s favorite time of year? You guessed it, Christmas, because that’s when everyone’s home is loaded up with brand new gifts ripe for the taking. Now, have you taken a good hard look at homeowner’s, or renter’s insurance policies to make sure that you have adequate coverage should any of these things happen to you? Now is an excellent time to do that so to help you out, I’m going to point out just a few key things you want to look for to make sure your family is covered in the event of an unfortunate loss.

1. Do you have Replacement Cost coverage on your residence (or your Personal Property coverage if you have renter’s policy)? If you don’t then you have Actual Cash Value which is a depreciated value. If you have ACV, should you have a total loss (ex. House burns to the ground), you aren’t likely to receive enough back to cover 100% of the cost to re-build in the same location.

2. Are your limits adequate? For homeowner’s the insured value of your house is NOT the same as the market value or assessed tax value. You want to have your home insured for what it would cost to re-build that exact same house from the ground up at today’s construction cost. In most cases that’s more than what you can sell it for. Insurable value and market value are two totally different things so don’t get the two confused. For renter’s is your personal property limit adequate to replace everything you own? I ask my client to think about it like this, if your rental burned down and you lost everything inside, how much would it cost you to replace EVERYTHING down to socks and underwear? Don’t think about just high dollar items like TV’s and furniture, consider it all. If you’re not sure on what limit your home should be covered at, your agent should be able to provide a Replacement Cost Calculator at no charge so that you can review your limits.

3. What is your deductible? The higher the deductible the lower the premium, but often times the difference between a $500 deductible and a $1000 deductible is just a few dollars. The question is how easy would it be for you to come up with the extra $500 if you suffered a loss? For me it would be difficult. To some it’s not a big deal, but it’s definitely something worth thinking about. Your agent should be able to give you a quote on the premium difference between different deductible levels relatively easily.

4. Flood and Earthquake? Do you live in an area that is prone to these events? If so you need to realize that your Homeowners or Renters policy does not cover flood and earthquake. If you have a loss related to either of those, you will not have coverage unless you have placed a separate flood &/or earthquake policy. Many banks will require the additional policy for those located in high risk areas as a pre-requisite to funding the loan, but for those who have no mortgage or renters who may not realize it, it’s definitely worth thinking about.

5. What is your coverage form? What are the exclusions? You’ve checked your limits and your valuation, but what about the coverage form. What perils are covered for loss and more important, what perils are excluded? Do you live in the mid-west and have wind and hail exclusion? Do you live near a hillside and have mudslide excluded? Probably not the best form for your needs. Make sure you read your policy or ask your agent what the exclusions are in your policy and if some of them seem like things you would really want to be included you may want to consider some other options.

Regardless of what your answers to all of these questions, the truth is that some coverage, even the most basic of policies is better than none at all. Not everyone, including myself, can afford the “Cadillac” of insurance policies, but those of us that can’t are generally ones that need good coverage most. If you needed to use the insurance it’s something you certainly could not afford to be without at the time.

Do you have a homeowners or renters policy? Why or why not? What questions do you have about coverage? Let me know in the comments below and thanks for reading!

Leave a Reply